Consumers trust banks/credit unions, private companies and health care providers most to handle personal information; Organizations face adverse consequences if a cyber incident is mishandled

ReputationUs (RepUs) and DHM Research released results from a first-of-its-kind study during Cybersecurity Awareness Month (October) that examines the effects of cyberattacks on corporate reputation and consumer confidence. The study surveyed 562 adults in Oregon. Complete details about the survey, including an analysis of the findings and a list of key insights are available at ReputationUs.com/CyberSurvey and DHMresearch.com/CyberSurvey.

According to the study, consumers trust banks/credit unions, private companies and health care providers most to protect their personal information (e.g., financial, medical). However, if a cyberattack is mishandled, these organizations potentially face a significant loss of customers. The study also substantiates the importance of communications, transparency, and proactively offering customer credit monitoring during and after a cyberattack.

“While consumers hold organizations to high standards, they also understand that cyberattacks do occur,” said Casey Boggs, president of RepUs, a firm specializing in reputation management and cybersecurity preparations. “The key to mitigate against the impact of an attack is proper planning and knowing customers’ expectations in advance.”

“The vast majority of survey participants (73%) indicated that they have had their personal information compromised,” added John Horvick, client relations and political director at DHM Research. “Consumers are increasingly anxious to know what companies are doing to protect their personal information. Companies that communicate about cyber risks, and how they are protecting customer information, are the most trusted.”

CYBERSECURITY AND REPUTATION: BY THE NUMBERS

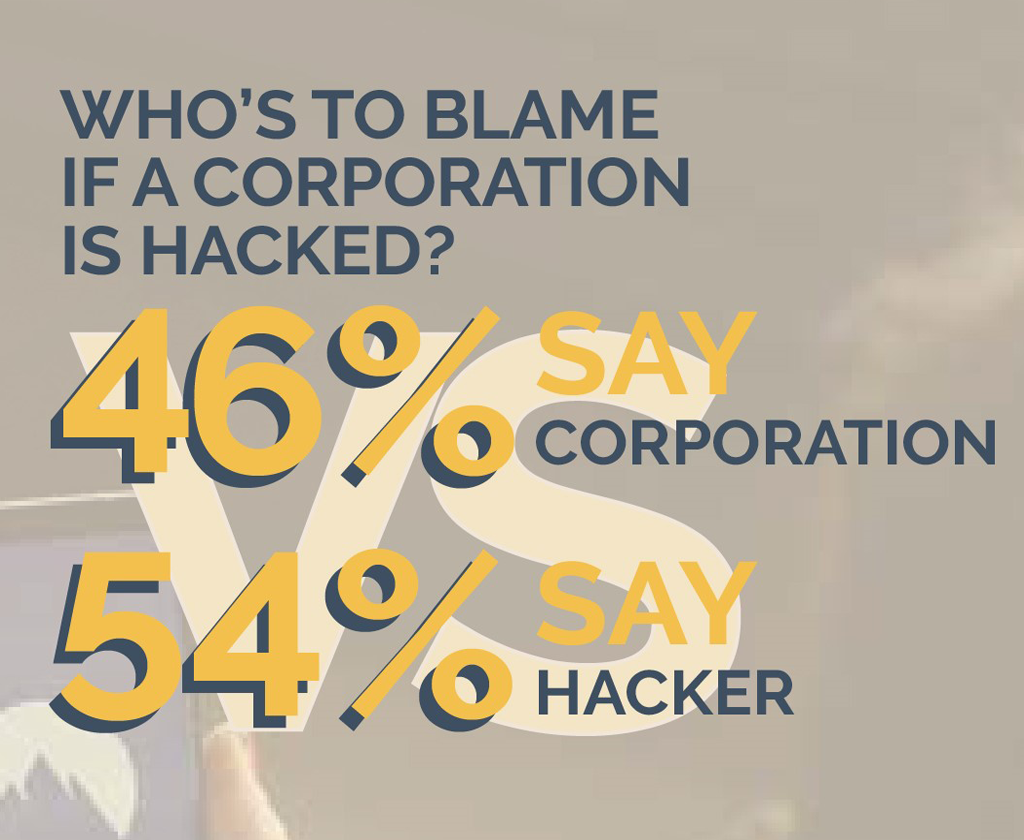

- 54% Hacker Vs. 46% Corporation – Who’s to blame if a company is hacked.

- Consumer confidence level by industry to protect private information:

- 84% – Bank/Credit Union

- 74% – Health Care Provider

- 66% – Health Insurance Provider

- 64% – Credit Card Company

- 50% – Internet Provider

- 48% – Mobile Phone Provider

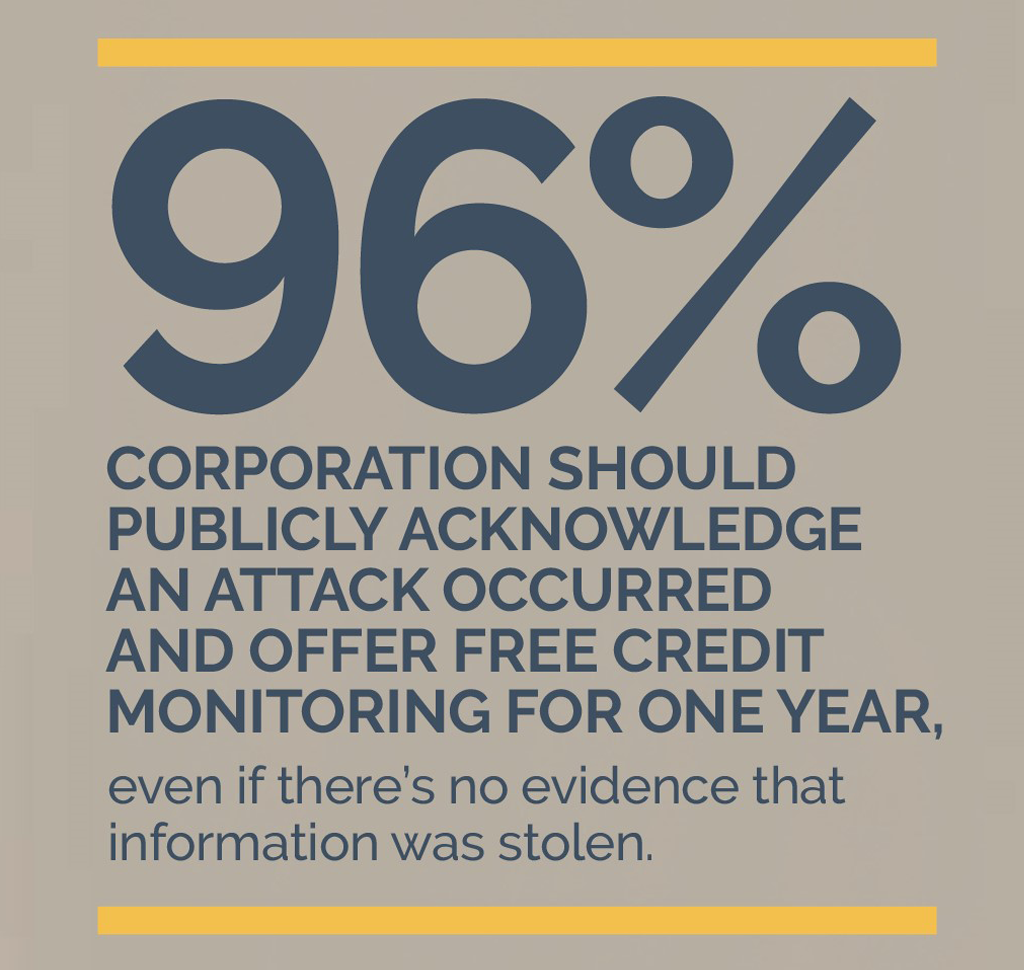

- 96% – Consumers believe companies should publicly acknowledge an attack occurred and offer free credit monitoring for one year, even if there is no evidence that information was stolen.

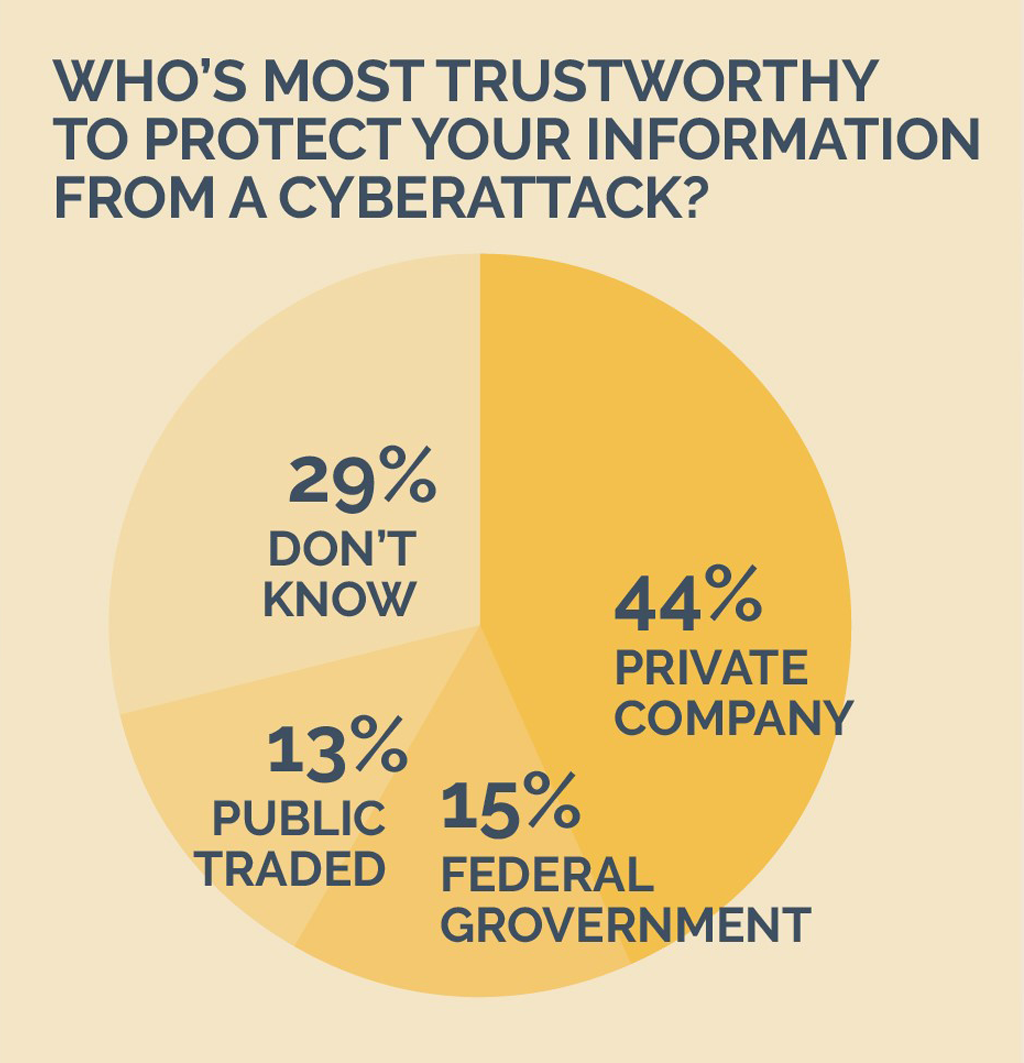

- Who’s most trustworthy to protect personal information from a cyberattack:

- 44% – Private Company

- 15% – Federal Government

- 13% – Publicly Traded Company

- 60% – Consumers trust a large business that was recently a victim of a cyberattack and then upgraded its security procedures after the attack.

- 8% – Consumers trust a corporation that has never said whether it has been a cyberattack victim.

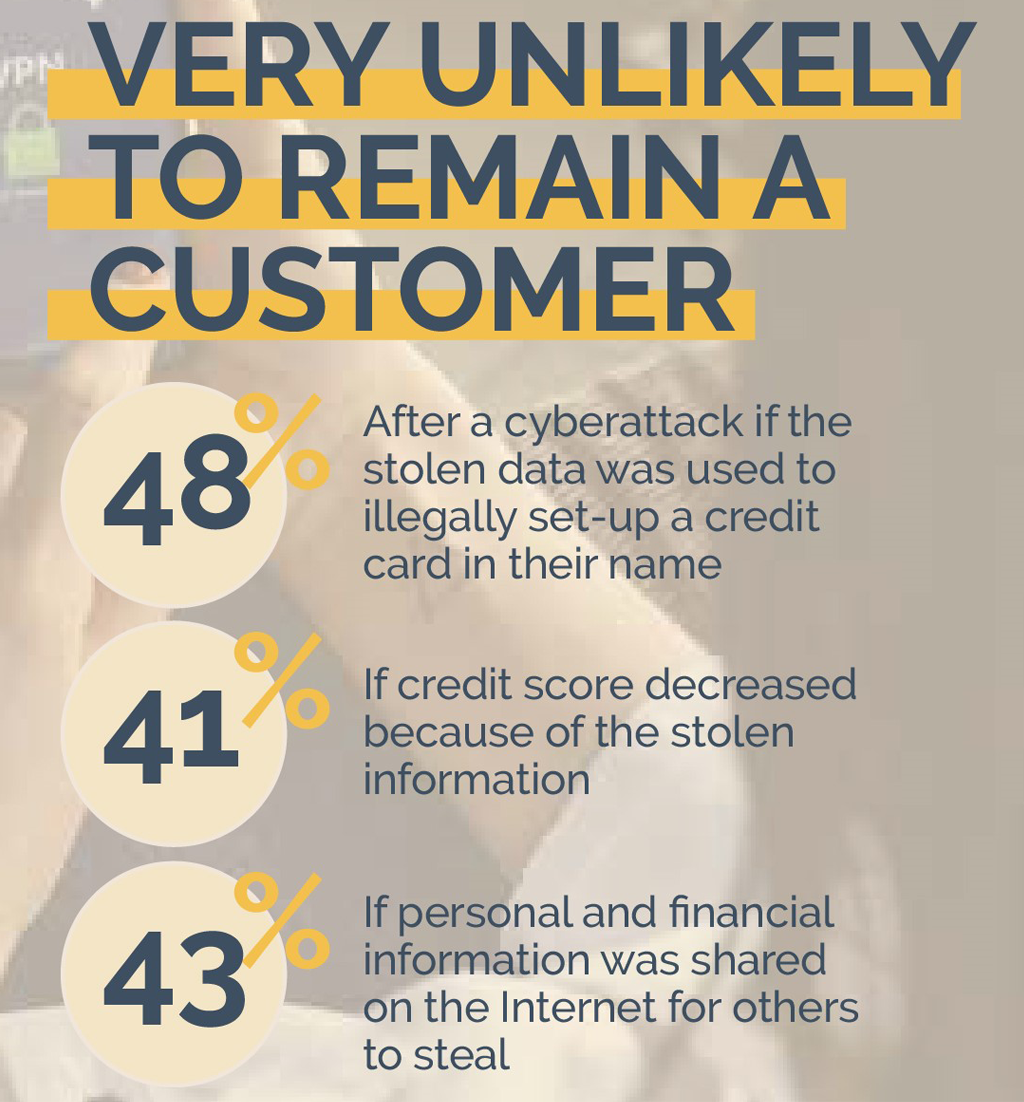

- 48% – Consumers are very unlikely to remain a customer after a cyberattack if the stolen data was used to illegally set-up a credit card in their name.

- 41% – Consumers are very unlikely to remain a customer if their credit score decreased because of stolen information.

- 43% – Consumers are very unlikely to remain a customer if their personal and financial information was shared on the Internet for others to steal.